Overview

In 2021, there were over 200,000 Canadians involved in motor vehicle accidents, according to Transport Canada’s National Collision Database. According to the same source, almost 50% of those involved in motor vehicle accidents were injured.

After you get in a car accident, you may wonder: is it worth getting a personal injury lawyer? What am I entitled to if I am injured in a car accident? How does car insurance work when I have been involved in an accident?

As you navigate life after your accident, dealing with insurance companies, recovery, and returning to work can feel overwhelming. Seeking legal advice early in the process is one way people sustaining injuries from car accidents can ensure they receive the compensation they are entitled to.

Speak to a Car Accident Injury Lawyer.

On This Page

Why Do I Need a Personal Injury Lawyer for My Car Accident

What to Do After a Car Accident in New Brunswick?

If you experience a motor vehicle accident in New Brunswick, your first priority is safety. Once everyone is out of danger, take the following steps to protect your health, your rights, and any potential insurance claim:

1

Ensure safety and call for help: Check for injuries and call 911 if anyone is hurt or the scene is unsafe. If possible, move vehicles out of traffic and turn on hazard lights to prevent further accidents.

2

Exchange information: Trade contact and insurance details with the other driver(s) involved, including names, phone numbers, license plate numbers, and insurance policy numbers. This information is crucial for filing insurance claims.

3

Gather evidence: If you can, take photos of the vehicles, the overall scene, and any visible injuries. Note the time, location, and road conditions. If there are witnesses, get their names and contact info. These details can help establish what happened and who was at fault.

4

Report the accident to police: In New Brunswick, accidents that cause any injury or over $1,000 in property damage must be reported to law enforcement. Even for minor fender-benders, it’s wise to have a police report for an official, unbiased record of the incident.

5

Notify your insurance company: Contact your auto insurer as soon as possible to report the collision. Provide them with the basic facts. Prompt notification is often required by insurance policies and it ensures you can access benefits like vehicle repairs and medical coverage.

6

Seek medical attention: See a doctor as soon as you can, even if you feel fine. Some car accident injuries (like whiplash or concussions) may not show symptoms right away. A medical exam protects your health and creates a record of any injuries in case you pursue a claim.

The moments after a crash can be overwhelming, but following these steps will help protect you both medically and legally. If you’re unsure about the next steps or feeling stressed, our car accident lawyers are here to support you. Contact us for a free consultation.

How Does Car Insurance Work When You are Injured in Car Accident?

Under each province's Insurance Act, four sections of may apply to car accident victims. Each province has its own Insurance Act.

There are two insurance companies involved: the first is your insurance company, and it is the Section B automobile insurer. The second is the insurance company for the at-fault driver, called the Section A insurer. A claim against Section A insurance is when the driver who was not at-fault is seeking compensation for lost wages, pain and suffering and the cost of future medical or paramedical treatment.

The Section A insurer and the driver who was not at-fault have an adversarial relationship. They are often cordial and even friendly, but they have no legal obligation to help or compensate you. They insure a third party–not you–and these obligations are to their stakeholders and the third party.

If you’ve been injured in an accident and the at-fault driver’s insurer asks you to provide a written or oral statement, it is often best to speak with an injury lawyer before complying. You are not required to make a statement to the at-fault driver’s insurance company.

How long do I have to file a claim after a car accident in New Brunswick?

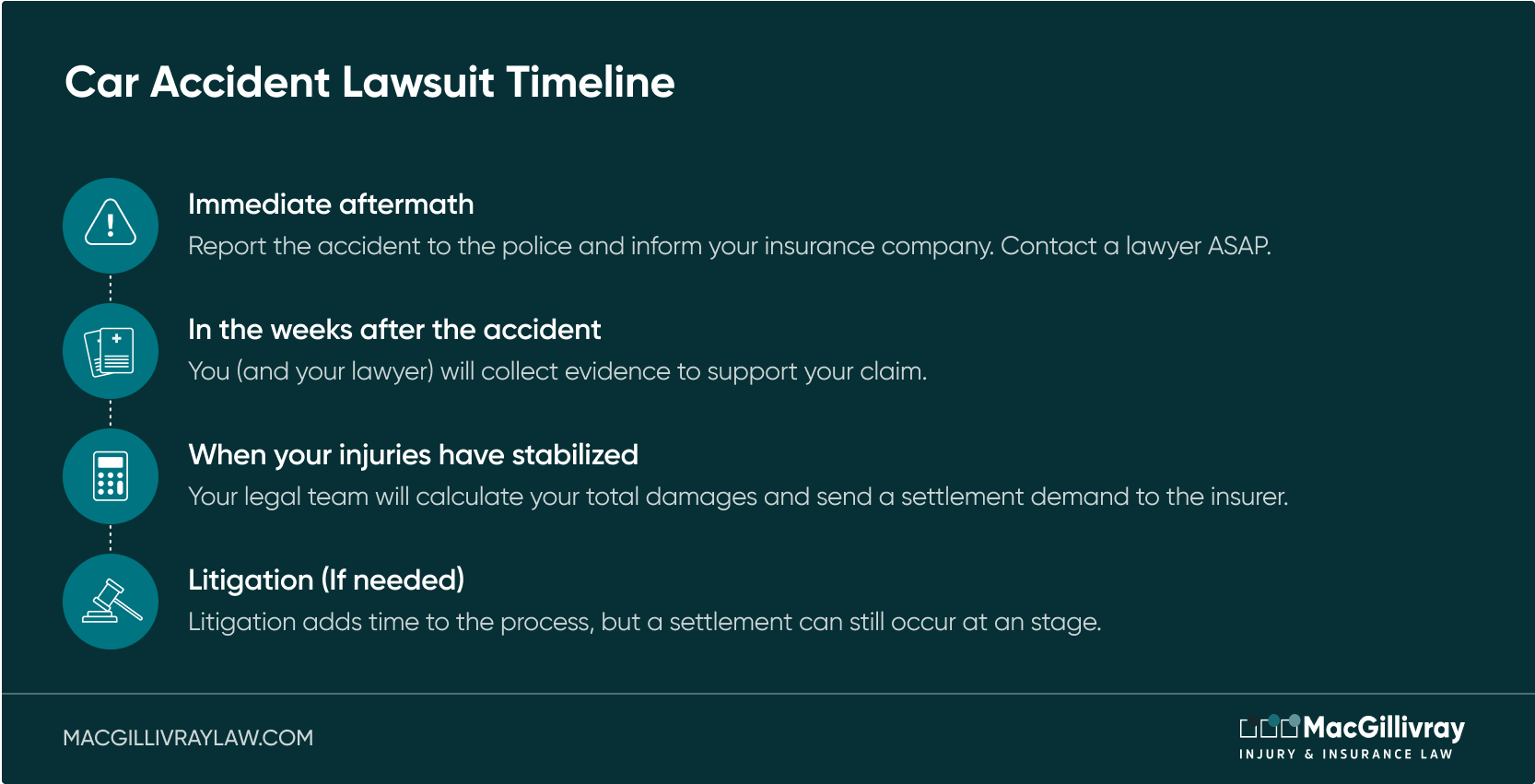

In general, the legal limitation period for filing a motor vehicle accident claim is two years from the date of the accident in New Brunswick, although there are exceptions. There are other time limits that apply to no-fault claims under Section B in Atlantic Canada. At MacGillivray Law, we typically file a lawsuit against the at-fault driver one year after the date of the accident, or once your injuries have healed or the extent of your injuries can be accurately assessed.

It is important to contact a lawyer as soon as possible after a car accident occurs. It is your lawyer’s job to build a strong case for you, which may include preserving evidence from the scene of the accident, gathering witness statements, and consulting with accident reconstruction specialists. The sooner you engage a lawyer, the sooner they can begin their work gathering time-sensitive evidence. Contacting a lawyer promptly also helps ensure that all timelines are met in the litigation process so that your claim can be pursued successfully.

How is Compensation from a Car Accident Injury Valued?

The value of a car accident is based on heads of damages, which are the types of losses that an injured person faces as a result of their accident. These damages include:

General Damages: The general damages portion of an injury claim is to compensate people for their pain, suffering, and loss of enjoyment in their life. General damages vary based on the type of injury a person sustained.

Lost Wages: Past lost wages describe compensation for the wages you lost, incluing time off immediately following an accident, time off for medical appointment and therapy, and any leaves you may have needed to take as a result of your injury.

Medical Expenses: Medical expenses are costs incurred as part of your diagnosis, care, and treatment. These costs include ambulance fees, expenses from the hospital, physical therapy, fees associated with diagnostics and imaging, prescription medication, medical supplies, and other related expenses.

Loss of Earning Capacity: Loss of earning capacity describe a lump sum award when a person has lost some of their ability to work due to their injuries, but the loss cannot be calculated with precision.

Future Lost Wages: Future lost wages describe the compensation received by an injured party for the wages they will not receive in the future because they have had to stop working due to their injuries.

Loss of Essential Services: Loss of valuable services covers the cost of housekeeping, home maintenance, and other essential services that an injured person may require after their car accident if they are no longer able to do that work after their injury.

Common Injuries Car Accidents May Cause

At MacGillivray Injury Law, we work with clients involved in car accidents in New Brunswick every day. While every case is unique, there are some common injuries stemming from car accidents

Common Types of Motor Vehicle Collisions

We represent people who have been injured in many different types of motor vehicle collisions in New Brunswick, including:

- Head-on collisions

- Rear-end collisions

- Side swipes and collisions during a lane change

- T-bone collisions

- Collisions with objects or animals

- Hitting a parked car

- Run off the road by another vehicle

- Vehicle rollovers

- Being hit when turning left into traffic

- Cyclist accidents

- Pedestrian accidents

Do I Have to Make a Statement to the Insurer for the Driver Who Was at Fault?

If you’ve been injured and the at-fault driver’s insurer asks for a written or oral statement, speak to an injury lawyer before complying. You are not required to make a statement to the at-fault driver’s insurance company.

Information

Advantages

What you tell the insurance company may improve a settlement offer as they will have more information for their file

Twisted

Disadvantages

The information you give them could be used down the road and taken out of context later.

Openness

Advantages

Talking to the other driver’s insurance company indicates to them that you are open to working things out.

Downplay

Disadvantages

Some people downplay their injuries when discussing them with a professional to avoid exaggerating them. This can hurt your case and be used to offer you less than you really deserve.

Rapport

Advantages

You may build a relationship with the other insurance company which could help you work things out with them.

Mixed-Up

Disadvantages

You may feel nervous and say something that isn’t correct by mistake. This can be used against you and would hurt your credibility.

Tips for Speaking to Either Insurance Company

Be truthful. Always be honest in your recollection of what happened.

Be certain. Only share information that you are certain of.

Don’t overshare. If asked a question, provide only the answer.

Don’t downplay your injuries. Your statements to insurance companies need to accurately reflect your injuries.

Review the facts of your case before hand. Review any notes you have of the accident or your medical treatment before hand

Ask for clarification. Don’t be afraid to ask for clarification before you begin answering.

What Our Clients Say...

Frequently Asked Questions

Not necessarily. Fault is determined on a case-by-case basis. While some accident types may strongly indicate that one party was responsible, like being rear-ended by a speeding vehicle, it is not necessarily the case in all circumstances.

While insurance companies and police provide evidence in determining who is at-fault in a car accident, it is ultimately decided by the Courts.

The party who is at fault will be liable for the damages caused by an accident, including injuries.

In general, the legal limitation period for filing a motor vehicle accident claim is two years from the date of the accident in New Brunswick, although there are exceptions. There are other time limits that apply to no-fault claims under Section B in Atlantic Canada. At MacGillivray Law, we typically file a lawsuit against the at-fault driver one year after the date of the accident, or once your injuries have healed or the extent of your injuries can be accurately assessed.

It is important to contact a lawyer as soon as possible after a car accident occurs. It is your lawyer’s job to build a strong case for you, which may include preserving evidence from the scene of the accident, gathering witness statements, and consulting with accident reconstruction specialists. The sooner you engage a lawyer, the sooner they can begin their work gathering time-sensitive evidence. Contacting a lawyer promptly also helps ensure that all timelines are met in the litigation process so that your claim can be pursued successfully.

Not necessarily. Fault is determined on a case-by-case basis. While some accident types may strongly indicate that one party was responsible, like being rear-ended by a speeding vehicle, it is not necessarily the case in all circumstances.

While insurance companies and police provide evidence in determining who is at-fault in a car accident, it is ultimately decided by the Courts.

The party who is at fault will be liable for the damages caused by the car accident, including injuries.

Yes, you are obliged to cooperate with your insurance company if you want to remain entitled to benefits. In New Brunswick, your own insurer, or the insurer for the car you were in, is called the Section B accident benefits insurer. You are in a contractual relationship with your Section B insurer. This means that you each have obligations and duties to one another under the contract. One of your duties is to provide them with the information they need to adjust your claim.

If you are injured by a driver who doesn’t have insurance, your own insurance policy will protect you against these losses. You will not be penalized for the other driver’s decision to drive uninsured. This coverage stems from Section D of your auto insurance policy in New Brunswick.

If you are the victim of a hit and run car accident, you can still recover compensation for your injuries, even though you do not know who injured you. Your insurance policy protects you against losses suffered because of an unidentified driver. In New Brunswick, you are covered for this loss under Section D of your auto insurance policy.

A minor injury cap limits the amount of general damages you can claim for pain and suffering and loss of enjoyable activities. It typically applies to whiplash, whiplash-associated disorder and other soft tissue injuries that don’t substantially interfere with daily life. An injury could be over this threshold because of the effects it has on a person. We are often able to advocate that an injury is over the cap even when the insurer says it applies. The minor injury cap in New Brunswick in 2026 is $9,926.59.

Not necessarily. Fault is determined on a case-by-case basis. While some accident types may strongly indicate that one party was responsible, like being rear-ended by a speeding vehicle, it is not necessarily the case in all circumstances.

While insurance companies and police provide evidence in determining who is at-fault in a car accident, it is ultimately decided by the Courts.

The party who is at fault will be liable for the damages caused by an accident, including injuries.