In 2022, 27% of Canadians aged 15 years and older reported they had one or more disabilities that limited them in their daily activities, up from 22% in 2017, according to the Canadian Survey on Disability from 2017 to 2022 from Statistics Canada. According to the same source, part of this increase was attributed to an increase in mental health-related disabilities. People living in Atlantic Canada experienced some of the highest increases in disability rates in the country.

If you become disabled or your disability begins to contribute to impairments that make you unable to work, you may wonder: Do I qualify for long-term disability benefits? Is it worth getting a lawyer? When should a lawyer get involved in a disability claim? How does long-term disability work and what do I have to tell my employer? What do I do when my LTD benefits are cut off? Do I have to return to work?

As you navigate life with functional impairments, dealing with insurance companies, recovery, and the possibility of returning to work can feel overwhelming. Seeking legal advice early in the process is one way people making a long-term disability claim can ensure they receive the compensation they are entitled to.

What are long term disability (LTD) benefits?

Long Term Disability (LTD) benefits are monthly payments you receive from an insurance company when you are unable to work for medical reasons, typically provided as a group insurance plan through your employer or union. You can also buy individual Long Term Disability policies from a broker if you are self-employed or not covered by a group insurance policy through your employer.

LTD insurance policies generally cover a percentage of your income if you meet the definition of “total disability” or “totally disabled” under your LTD policy. The terms “total disability” or “totally disabled” are insurance terms and do not mean that you have to be in hospital in order to qualify for LTD benefits. These terms are defined in each policy, but typically mean that you are unable to engage in your regular occupation as a result of one or more disabling conditions.

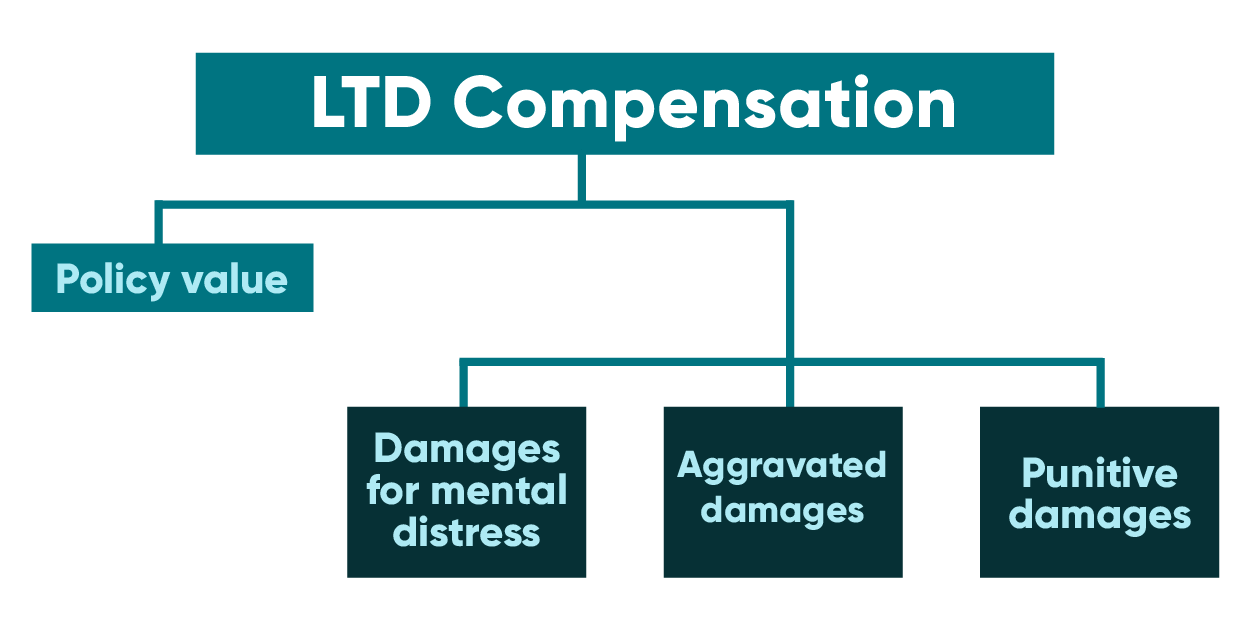

LTD benefits typically replace a percentage of your income for the period of time you are totally or partially disabled – this will depend on your coverage and the language in the policy. If you are wrongly denied benefits, you may become entitled to mental distress damages, aggravated damages, and/or punitive damages.

LTD policies are characterized as “peace of mind contracts” and when an insured person is wrongly denied benefits, the courts recognize that mental distress will usually be a consequence of an insurance company breaching that type of contract. Insurance companies have an implied obligation to exercise good faith and a wrongly rejected claim under an LTD policy may constitute a breach of that obligation. Any of these breaches may give rise to an additional claim for damages.

LTD insurance policies might vary on the following features:

- to what age the benefits are payable. Most commonly LTD benefits are payable to age 65 but some policies provide benefits only to age 60, while others may provide benefits to age 70.

- the amount of your monthly LTD benefit. It is usually a percentage of your income but sometimes it is a set payment.

- the definition of “total disability”, the wording can vary slightly from company to company and many LTD insurers provide “own occupation” coverage for the first two years and after that you must be disabled from “any occupation”, these are legal terms that are explained in more detail below.

- the offsets on your monthly LTD benefit vary on different policies. Most policies deduct Canada Pension Plan Disability (CPPD) (more on CPPD below) from the LTD payment but not all. Other possible offsets include other LTD policies you may be covered under or Workers’ Compensation benefits.

What can I do if my insurance company denied my LTD claim?

LTD insurers sometimes deny payments to a person who has applied. Other times, the LTD insurer terminates benefits for a person who has already been receiving LTD benefits. The LTD insurers will terminate or deny LTD benefits when, in their opinion, there is not enough evidence to support that you cannot work. They frequently get opinions from their own medical team to support their decisions.

Some disabling conditions cannot be proven through “objective evidence, like x-rays or CT scans.” Chronic pain and psychological diagnoses are often reliant on subjective reporting, which means there is less objective medical evidence. A lawyer with experience handling LTD claims will know the right way to get the best evidence in the event of a denial or a termination for lack of “objective evidence” supporting your disability.

An experienced lawyer knows the right questions to ask your doctors to compile the best evidence in support of your disability claim. Where necessary, a lawyer will refer you to a specialist doctor who will provide an Independent Medical Examination to further support your claim. Lawyers are also skilled at conducting legal research related to disability policies. Finally, a lawyer can help move the case towards a resolution by meeting Court deadlines and pushing the case closer to the point where the Court can make your insurance company pay out your benefits.

What are your legal options when LTD benefits have been denied or terminated?

If your LTD benefits have been denied or terminated you have two options. You can appeal the decision internally by writing to the LTD insurer and going through their internal appeals process. The second option is to sue your LTD insurer for breach of contract.

There are different time limits that you should be aware of for each option. First, for an internal appeal, there will be deadlines set out in your denial letter that dictate how long you have to submit documents in support of your appeal. Second, if you pursue a lawsuit against your insurer, you typically have two years to file your claim.

The time limit is set out in your province’s legislation. We have linked to the relevant legislation for each of the Atlantic provinces below for your convenience. While the general limitation period in each of the Atlantic provinces is two years, there may be exceptions. For this reason, it is important to consult with a lawyer following a denial or termination of disability benefits to ensure your right to pursue one of these options is protected.

Nova Scotia’s Limitation of Actions Act

Newfoundland and Labrador’s Limitations Act

New Brunswick’s Limitation of Actions Act

Prince Edward Island’s Statute of Limitations

There are advantages and disadvantages to appealing internally versus suing your LTD insurer. These considerations are specific to your individual circumstances and would best be evaluated in consultation with a lawyer.

What is the difference between “own occupation” and “any occupation”?

Typically, an LTD policy will provide coverage for a set period of time when an insured person is unable to perform the duties of their own occupation. After that set period of time – often two years (24 months) into receiving benefits – many policies state that in order to keep receiving benefits, the insured person must be unable to perform the duties of any occupation. This is often the point where an LTD insurer will stop paying benefits.

Being disabled from “any occupation” does not mean that you have to show you can do any job. The term “any occupation” means an occupation that the insured person is reasonably suited for by education, training or experience.

If your LTD benefits have been stopped because the insurance company thinks you can work in a different job that pays much less than your old job, you might have legal options. Our team can review your policy and your situation to make sure the insurance company is doing what it should.

What happens if you don’t follow the recovery plan recommended by your doctors?

If you do not take part in the recovery programs your doctors recommend, your insurance company might stop your benefits. When you’re applying for or getting long-term disability benefits, it’s important to do everything you can to get better. This includes following any recovery programs your doctors recommend. LTD policies will sometimes specifically say that you have a duty to lessen your injuries as much as possible. Even if it is not specifically mentioned, the Courts will not look favorably on your case if you are not following medical advice.

If you do not agree with a specific doctor’s recommendations, you should get a second opinion. Your legal team can help here to help your LTD insurance company understand why you did not want to follow a specific treatment plan.

How much pain do you have to have before you can stop working?

If you can struggle through a workday, but it causes you significant pain, either during or after your workday, you may be entitled to Long Term Disability insurance. If working results in an unreasonable amount of pain, you might not be medically fit to work. It’s not just about being able to do the job – it’s also about whether the job causes you undue suffering. You shouldn’t be expected to work at a job that causes you significant pain, either during work or afterwards. Pain is difficult to measure, so you have to communicate to your doctors honestly and frankly without downplaying the problems you are having.

Can social media posts impact my LTD claim?

Yes, your social media posts can influence your LTD claim. Honesty is crucial when applying for LTD benefits, especially for “invisible illnesses” that can’t be easily measured by medical tests. Your credibility plays a significant role in these situations.

It’s important not to exaggerate or be inconsistent when reporting symptoms. Similarly, downplaying your symptoms on public platforms like social media can be detrimental. Insurance companies can access your social media posts and use them against you during litigation. For instance, if you post photos or videos of yourself doing activities that you claim your disability prevents you from doing, it could harm your credibility.

Remember, even if you’ve set your social media privacy settings to the highest level, a court can order you to produce these documents if the insurance company can prove their relevance.

Can I apply for Canada Pension Plan Disability (CPPD) if I receive LTD benefits?

You can always apply for CPPD benefits, and if you have been approved for both Canada Pension Plan Disability benefits (CPPD) and LTD benefits, you can indeed draw from both sources. However, there is sometimes a catch. Any benefits you receive from CPPD might be subtracted from your LTD policy benefits. This process, known as ‘offsetting,’ reduces the payout from the insurance policy by the amount received from another income source. The specifics of whether CPPD benefits are offset will be detailed in your LTD policy.

Can I get a lump sum settlement for my LTD claim?

If you have been denied LTD benefits, a lump sum settlement may be available to you. A lump sum settlement is a one-time payment made to you. It represents the total of your insurance policy, including your back benefits and the value of future disability payments. In return, you agree that the lump sum is all you’re entitled to under the policy, and you give up your rights to future benefits.

Negotiating a lump sum settlement includes negotiating for any damages you may be entitled to in addition to the benefits – past, present, and future – that you are owed.

What is the difference between a reinstatement of benefits and a lump sum settlement?

Reinstatement of long-term disability benefits refers to the resumption of your regular benefit payments after they’ve been stopped. The court can’t force the LTD insurer to pay you a lump sum. The Judge can award legal costs, aggravated damages, back payments, and order reinstatement going forward, but not a lump sum amount. If you accept a lump sum payment, you give up any further claims you might have under the policy or in Court.

Which should I choose? A lump sum settlement or a reinstatement of my benefits?

Whether you should seek a lump sum settlement or reinstatement of your LTD benefits depends on various factors, including your financial needs, the terms of your policy, and the nature of your disability. Remember, if your case goes to trial, a judge can only order reinstatement of benefits.

What are the benefits of a lump-sum settlement in LTD claims?

- Closure and certainty: A lump-sum settlement gives you a sense of closure as it eliminates the uncertainty of future benefits. With reinstatement, there’s always a risk that your benefits could be terminated again. A lump-sum payment, on the other hand, provides a definite amount upfront.

- Tax advantages: The Supreme Court of Canada has ruled that only the arrears portion of a lump sum settlement is taxable. The amount allocated for future benefits is not taxable. This could result in significant tax savings.

- Freedom to work: If your health improves and you’re able to return to work, a lump-sum settlement allows you to do so without having to report to an insurance company.

- Security for your family: If you have concerns about your life expectancy, a lump-sum payment ensures that a set amount of money is available to your family now.

What happens if I am receiving LTD because of injuries from a car accident and I decide to sue the person responsible for my injuries?

If you’ve been in an accident that resulted in disabling injuries and have received long-term disability benefits, your insurer might be entitled to a part of any settlement you receive. Specifically, they may claim a portion of the settlement awarded for past or future earnings. This process is known as ‘subrogation’ in legal terms. The extent to which they can do this depends on your specific policy. There are several considerations and your lawyer for the car accident should assist you in negotiating with your LTD insurer.

MacGillivray Law can help you get fair compensation

Having your long term disability denied or terminated by an insurance company can be a stressful experience. Our lawyers will help you determine the best course of action to have your benefits reinstated or dispute a denied claim. Contact us today for a free consultation.

Request a

Free Consultation

If you would like to learn your legal options at no obligation, contact us today to set up a free consultation.