Overview

In 2024, the RCMP reported 77 fatal vehicle accidents and 180 major injury collisions in Nova Scotia. Whether your accident happened in Halifax, New Glasgow, or anywhere across Nova Scotia, you deserve experienced legal support.

Dealing with insurance companies, medical appointments, and returning to work can feel overwhelming when you’re recovering from injuries. That’s why seeking legal advice early is crucial.

With offices in Halifax and New Glasgow, MacGillivray Injury Law helps accident victims throughout Nova Scotia – from Cape Breton to Yarmouth – secure the compensation they’re entitled to.

Speak to a Car Accident Injury Lawyer.

On This Page

Understanding Car Accident Claims in Nova Scotia

Every year, thousands of Nova Scotians are injured in motor vehicle accidents, yet many don’t fully understand their legal rights or the true value of their claim. Insurance companies have teams of adjusters and lawyers working to minimize payouts—you need to be equally prepared. Understanding Nova Scotia’s unique insurance laws, including the Minor Injury Cap and tort deductibles, can mean the difference between accepting a lowball settlement and receiving fair compensation for your injuries, lost wages, and pain and suffering.

How Does Car Insurance Work When You are Injured in Car Accident?

Under each province's Insurance Act, there are four sections of auto insurance that may apply to car accident victims. Each province has its own Insurance Act.

- Section A(Liability Coverage): Section A applies when you are injured by a negligent driver. This is the primary avenue for recovering full compensation for your injuries. Section A insurance claims are made against the at-fault driver’s insurer to recover financial compensation for a victim’s injuries, including pain and suffering, lost wages, and medical expenses not covered by other benefits. Nova Scotia requires all drivers to carry minimum liability coverage of $500,000.

- Section B(No-Fault Accident Benefits): Section B covers mandatory accident benefits provided under your own insurance policy or that of the driver whose vehicle you were in as a passenger during the accident. These “no-fault” benefits are available regardless of who is at fault for the accident. Section B covers some medical and rehabilitation expenses (up to specified limits), an amount designated for your lost wages (typically $250/week), housekeeping benefits, and funeral and death expenses. These benefits provide immediate support while you pursue your Section A claim against the at-fault driver.

- Section C(Vehicle Repair or Replacement): Section C covers the cost of damage to your vehicle caused by the accident. This coverage is often included in the standard automobile policy but is not mandatory in Nova Scotia. It includes collision coverage (for accidents) and comprehensive coverage (for theft, vandalism, and other non-collision damage). You should check with your individual insurance provider to see if Section C coverage is available to you and understand your deductible amounts.

- Section D(Uninsured/Unidentified Motorist Coverage): Section D applies when you are injured by an uninsured driver or an unidentified driver, such as in a hit-and-run accident. This mandatory coverage ensures you’re not left without recourse if the at-fault driver cannot provide compensation. It acts as a safety net, providing similar benefits to what you would receive under Section A if the at-fault driver had proper insurance.

The Nova Scotia Minor Injury Cap

The Minor Injury Cap is a legislated limit on pain and suffering awards for injuries deemed “minor” under Nova Scotia’s Insurance Act. Insurance companies routinely use this cap to minimize settlements, often arguing that serious injuries fall under the cap when they don’t. Understanding whether your injury exceeds the cap is crucial to receiving fair compensation.

How much is the minor injury cap in 2025?

The 2025 Minor Injury Cap in Nova Scotia is set at $10,128 for pain and suffering damages. This amount is adjusted annually for inflation.

What injuries are considered “minor” under the cap?

The cap applies to sprains, strains, and whiplash-associated disorders (WAD I and II) that don’t result in serious impairment. However, the definition is often disputed, and many injuries initially labeled as “minor” can exceed the cap with proper medical documentation and legal representation.

Can concussions and whiplash exceed the minor injury cap?

Yes, concussions and severe whiplash can exceed the cap if they result in serious and permanent impairment of an important physical, mental, or psychological function. Post-concussion syndrome, cognitive impairment, chronic pain conditions, and psychological injuries like PTSD often surpass the cap.

Determining Fault and Liability in Nova Scotia Car Accidents

Who decides fault after a crash?

Initially, insurance adjusters determine fault using the Fault Determination Rules under the Insurance Act. However, their decision isn’t final. Police reports, witness statements, and accident reconstruction experts can challenge these determinations. Ultimately, if disputed, a court makes the final determination of liability.

Does my insurance go up if I’m not at fault?

Generally, your insurance premiums shouldn’t increase if you’re 0% at fault. However, insurers may still raise rates based on other factors. If you’re found partially at fault (even 1%), your premiums may increase. It’s crucial to dispute any fault determination you believe is incorrect.

Compensation and Settlement Process in Nova Scotia

What is the average car accident settlement in Nova Scotia?

Settlement values vary dramatically based on injury severity, impact on life, and long-term prognosis. Minor injury settlements typically range from $5,000-$25,000, while serious injuries can result in settlements from $50,000 to several million dollars. Factors include medical expenses, lost income, future care costs, and pain and suffering awards.

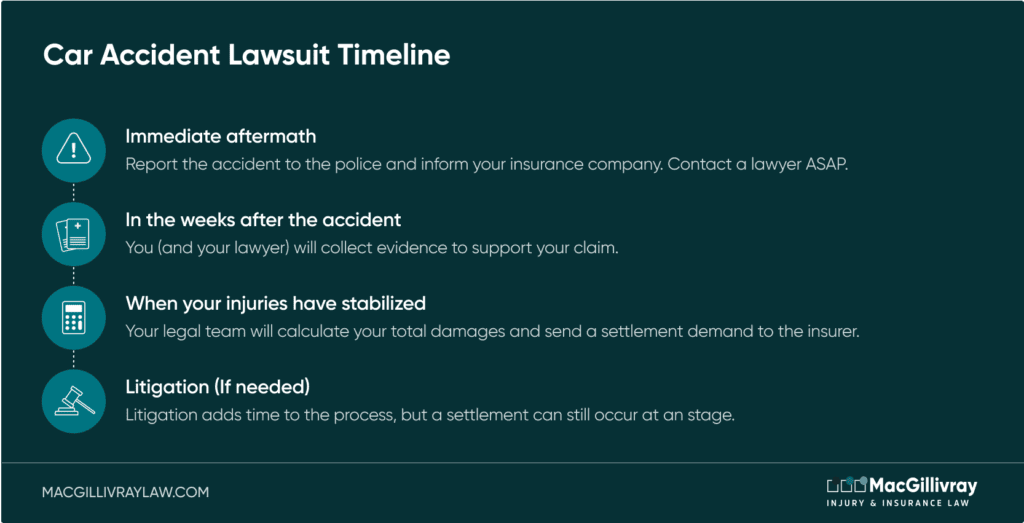

What is the car accident claim process?

- Immediate medical attention and documentation

- Report to police and your insurance company

- Access Section B no-fault benefits immediately

- Gather evidence (photos, witnesses, medical records)

- Treatment and recovery period

- Determination of maximum medical improvement

- Pursue Section A claim against at-fault driver’s insurer

- Calculation of damages and negotiation

- Settlement or litigation if necessary

What damages can I recover?

- Medical expenses: All reasonable treatment costs including future medical needs beyond Section B limits.

- Lost wages: Past and future income loss, including reduced earning capacity beyond Section B benefits.

- Pain and suffering: Compensation for physical pain, emotional distress, and loss of enjoyment of life. This non-economic damage recognizes the profound impact injuries have on your daily activities, relationships, and overall quality of life. Awards vary based on injury severity, duration of suffering, and permanent limitations.

- Out-of-pocket expenses: Transportation, medical devices, home modifications.

- Family claims: Loss of care, guidance, and companionship

Important Deadlines and Legal Timelines

How long do I have to sue after a car accident in Nova Scotia?

You have two years from the date of the accident to file a lawsuit in Nova Scotia. However, you must notify the at-fault driver within 120 days if you intend to claim damages. Missing these deadlines can bar your claim entirely. Some exceptions exist for minors and those with diminished capacity, but immediate action is always recommended.

Do I have to give a statement to the insurance company?

Yes. You must cooperate with your own insurance company as required by your policy, but you’re not obligated to provide a recorded statement to the other driver’s insurer. Any statements can be used to minimize your claim. Always consult a lawyer before giving detailed statements about the accident or your injuries.

When should I hire a lawyer?

Ideally, consult a lawyer immediately after seeking medical attention. Early legal involvement ensures evidence is preserved, deadlines are met, and you don’t inadvertently harm your claim. It’s especially critical if you have serious injuries, the fault is disputed, or the insurance company is pressuring you to settle quickly.

With over 30 years of experience, MacGillivray Injury Law has fought for fair compensation for people injured in car accidents across Nova Scotia. Contact us today for a free consultation.

Specialized Legal Situations We Handle

We represent people who have been injured in many different types of motor vehicle collisions in Nova Scotia, including:

- Rear-end collision claims

- Intersection and T-bone accidents

- Highway and multi-vehicle crashes

- Pedestrian accident injuries

- Cyclist collision claims

- Commercial truck accidents

- Uber/Lyft rideshare accidents

- Hit and run incidents

- Drunk driving victim claims

- Fatal accident wrongful death cases

Common Injuries Car Accidents May Cause

At MacGillivray Injury Law, we work with clients involved in car accidents in Nova Scotia every day. While every case is unique, there are some common injuries stemming from car accidents

Why Choose Our Nova Scotia Car Accident Lawyers?

Client Reviews and Testimonials

Frequently Asked Questions

- Ensure safety first – Check for injuries and move to a safe location if possible

- Call 911 – Report the accident to police and request medical assistance for any injuries

- Document everything – Take photos of vehicles, the scene, road conditions, and visible injuries

- Exchange information – Get driver details, insurance info, and witness contacts but avoid discussing fault

- Seek medical attention – Visit a hospital or doctor immediately, even for seemingly minor injuries, as symptoms can develop later and medical documentation is crucial for your claim

Most car accident lawyers in Nova Scotia work on a contingency fee basis, meaning you pay nothing upfront. Legal fees are typically 30-35% of your settlement, paid only if we win your case. Initial consultations are free, and we cover all case expenses during litigation.

Most car accident claims (approximately 95%) settle without going to trial. Settlement negotiations typically occur through your lawyer and the insurance company’s representatives. However, having a lawyer willing to go to court strengthens your negotiating position. If a fair settlement cannot be reached, litigation may be necessary. The court process involves discoveries (questioning under oath), potential mediation, and if needed, a trial. Even when lawsuits are filed, many cases still settle before the trial date. Your lawyer will prepare your case for trial while working toward a favorable settlement.

Not necessarily. Fault is determined on a case-by-case basis. While some accident types may strongly indicate that one party was responsible, like being rear-ended by a speeding vehicle, it is not necessarily the case in all circumstances.

While insurance companies and police provide evidence in determining who is at-fault in a car accident, it is ultimately decided by the Courts.

The party who is at fault will be liable for the damages caused by the car accident, including injuries.

Yes, you are obliged to cooperate with your insurance company if you want to remain entitled to benefits. In Nova Scotia, your own insurer, or the insurer for the car you were in, is called the Section B accident benefits insurer. You are in a contractual relationship with your Section B insurer. This means that you each have obligations and duties to one another under the contract. One of your duties is to provide them with the information they need to adjust your car accident injury claim.

Yes, you can still recover compensation through your own insurance policy’s Section D coverage. This protection is mandatory in Nova Scotia and covers you when hit by uninsured drivers, up to your policy limits.

Yes, Section D coverage protects hit-and-run victims when the at-fault driver cannot be identified. You must report the incident to police within 24 hours and notify your insurer promptly. Your own insurance will cover damages as if the unknown driver was uninsured.

Yes, family members can pursue a wrongful death claim under Nova Scotia’s Fatal Injuries Act. Spouses, children, parents, and other dependents may recover damages for loss of income, services, guidance, and companionship. These claims must be filed within two years of the death.