My long term disability benefits have been terminated, now what?

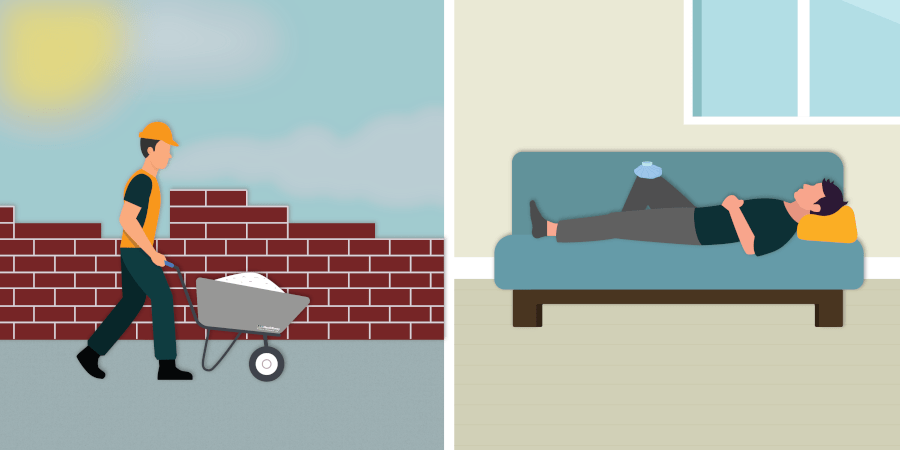

Long term disability benefits provide a much-needed lifeline for those injured in accidents. Still, many claimants may find themselves in a situation where their insurance company notifies them that their benefits have been cancelled. When these benefits are wrongfully terminated, it can leave people who are disabled from severe accidents in a lurch.

What are long term disability benefits?

Long Term Disability (LTD) benefits are monthly payments you receive from an insurance company if you are unable to work for medical reasons. You can buy individual Long Term Disability policies from a broker. You also may have group insurance through your work that provides LTD coverage, usually through your employer or union.

Some types of insurance policies – like motor vehicle insurance or fire insurance – are standardized by the legislature for the province. These policies are very similar no matter which insurance company you buy it from. However, there is no standard Long Term Disability policy. Each LTD insurer sells its own unique product.

Why were my LTD benefits terminated?

There are several reasons why an insurance company can terminate a person’s long-term disability benefits. The three main reasons why are:

- The person no longer meets the criteria for receiving LTD under the LTD policy;

- The person is not complying with the terms and provisions of the LTD policy; and

- The person has reached the policy’s age limit, which is often 65

The LTD insurers will terminate or deny LTD benefits when, in their opinion, there is not enough evidence to support that you cannot work. They frequently get opinions from their own medical team to support their decisions.

Some disabling conditions cannot be proven through “objective evidence,” like X-rays or CT scans. Chronic pain and psychological diagnoses are often reliant on subjective reporting, which means there is less objective medical evidence. A lawyer with experience handling LTD claims will know the right way to get the best evidence in the event of a termination for lack of “objective evidence” supporting your disability.

It is common for people to have their policy terminated after two years. Many policies are written in such a way that a person will receive benefits for the first two years if they are unable to return to their “own occupation.” After that two-year period, your eligibility may depend on if you are able to return to “any occupation,” which is a vocation that your work experience, training, pay level and education lends itself to you making 60% of your indexed monthly earnings. If you are able to return to “any occupation,” your benefits may be terminated.

Lathia explains “own occupation” vs. “any occupation.”

An experienced insurance lawyer is able to help you navigate the nuances of these issues to ensure you can claim the benefits you are rightfully entitled to.

What do I do if my long term disability benefits are terminated?

If your benefits have been terminated for any reason other than your age, we recommend that you reach out to schedule a free consultation to discuss your long term disability benefits. MacGillivray Law will be able to provide people who have had their long term disability benefits terminated with a comprehensive second opinion and will work with you to make sure you receive the benefits you are entitled to.

Request a

Free Consultation

If you would like to learn your legal options at no obligation, contact us today to set up a free consultation.