You should be very careful before accepting a settlement from your insurance company after a car accident in Sydney, Nova Scotia. Insurers often make quick offers that undervalue your injuries, lost wages, and long-term care needs. Once you sign, you cannot reopen your claim. A Sydney car accident lawyer can review your settlement and determine whether it reflects the true value of your injury claim. In most cases, it’s best to speak with a lawyer before accepting any offer.

According to the RCMP, Nova Scotia saw a significant rise in serious motor vehicle accidents in 2024. For crash victims in Sydney, this means more families are dealing with injuries, financial stress, and difficult insurance claims.

Life after a car accident can feel overwhelming — managing medical appointments, dealing with insurers, and trying to get back to work. Speaking with an experienced Sydney car accident lawyer early in the process helps ensure you receive the compensation you deserve.

What to Do After a Car Accident in Sydney, Nova Scotia

After a car accident in Sydney, your first priority is safety. Once everyone is out of danger, take the following steps to protect your health, your rights, and any potential insurance claim:

- Ensure safety and call for help: Check for injuries and call 911 if anyone is hurt or the scene is unsafe.If you can, move vehicles out of traffic and turn on hazard lights.

- Exchange information: Get names, phone numbers, license plates, and insurance details from all drivers involved. This information is crucial for filing insurance claims.

- Gather evidence: Take photos of the vehicles, the accident scene, and any visible injuries. Collect witness names and contact details. These details can help establish what happened and who was at fault.

- Report the accident to police: In Sydney, any collision involving injury or over $2,000 in property damage must be reported to law enforcement. A police report provides an official, unbiased record.

- Notify your insurance company: Contact your auto insurer as soon as possible to report the collision. Provide them with the basic facts. Prompt notification is often required by insurance policies and it ensures you can access benefits like vehicle repairs and medical coverage.

- Seek medical attention: See a doctor as soon as you can, even if you feel fine. Some car accident injuries (like whiplash or concussions) may not show symptoms right away. A medical exam protects your health and creates a record of any injuries in case you pursue a claim.

The moments after a crash can be overwhelming, but following these steps will help protect you both medically and legally. If you’re unsure about the next steps or feeling stressed, our Sydney car accident lawyers are here to support you. Contact us for a free consultation.

Do I Need to Report the Accident in Sydney?

Should I Call the Police After a Motor Vehicle Accident?

Yes. Under Nova Scotia law, you must report any accident that causes injury or damages exceeding $2,000. For minor fender-benders with no injuries, a report may not be legally required, but it is still wise. Some injuries don’t show up immediately, and damage estimates are often higher than expected. A police report creates neutral documentation, which can help if disputes arise or your injuries worsen.

When and Why I Must Report a Car Accident to Your Insurance in Sydney?

Beyond notifying police, you must also report the accident to your insurance company as soon as possible. Even if the crash was minor or not your fault, failing to notify your insurer could affect your coverage.

Stick to the facts when reporting. If you’re unsure how much to share, a lawyer can handle communication with insurers to protect your claim.

How long do I have to file a car accident lawsuit in Sydney?

In general, you have two years from the date of the accident to file a motor vehicle accident claim in Nova Scotia, although there are exceptions. There are also other time limits that apply to no-fault claims under your Section B insurance.

Time is of the essence when you’ve been involved in a motor vehicle accident. Engaging a lawyer promptly after an accident helps ensure that evidence from the scene of the accident, witness statements, and other time-sensitive support for your case is preserved.

If you wait too long, you may lose your right to sue the at-fault driver. We recommend that you engage a lawyer as soon as possible to secure your right to compensation.

Timeline of a Car Accident Claim in Sydney

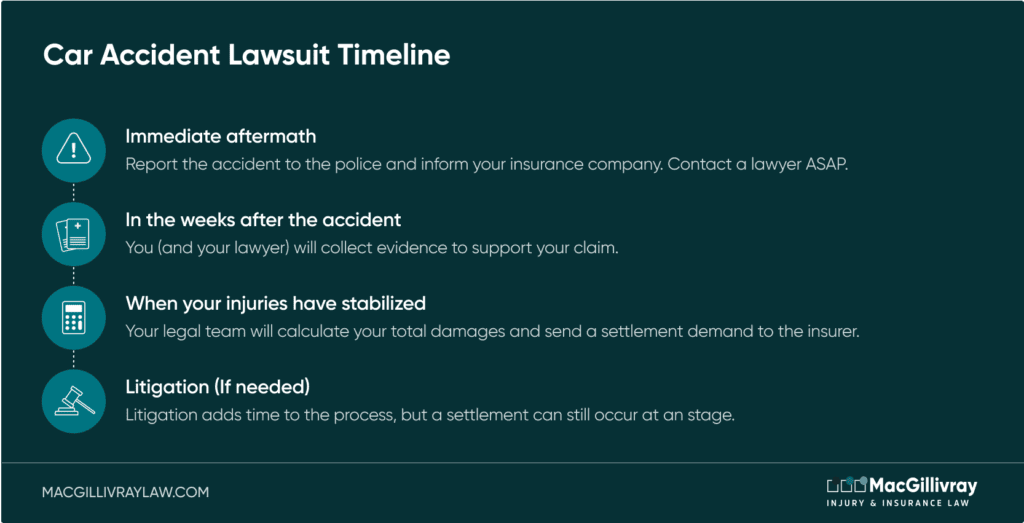

Every car accident claim in Sydney is unique, but most follow similar stages to reach a resolution. Here’s an overview of a typical claim timeline:

- Immediate aftermath: In the first days after the crash, focus on your health and on notifying the proper parties. Get prompt medical treatment and follow your doctor’s advice. Report the accident to the police and inform your insurance company right away. This is also a good time to consult a personal injury lawyer so they can start protecting your rights and gathering evidence.

- Investigation and documentation: In the weeks after the accident, you (and your lawyer) will collect evidence to support your claim. This includes police reports, medical records, bills, and repair estimates. During this phase, you may receive benefits from your insurer (Section B accident benefits in Nova Scotia) to cover immediate medical expenses or lost income while you recover.

- Claim evaluation and negotiation: Once your injuries have stabilized and you have a clear picture of your prognosis, your legal team will calculate your total damages (medical costs, lost wages, pain and suffering, and other losses) and send a settlement demand to the at-fault driver’s insurer. Then, both sides negotiate. This phase may take a few months. Often, a fair settlement is reached during negotiations, and the claim is resolved without seeing a courtroom.

- Litigation (if needed): In Nova Scotia, you have up to 2 years from the accident to start a lawsuit. Litigation adds time to the process, but a settlement can still occur at any stage. Most cases settle before reaching trial. If a trial does happen, the court will decide the outcome and award compensation.

Overall, a car accident claim can resolve in a few months or take a few years, depending on factors like the complexity of the case and whether a lawsuit is required. Throughout this process, an experienced Sydney car accident lawyer will keep things on track and fight for your rights while you focus on recovery. Our team works to resolve claims efficiently while maximizing the compensation you receive. Contact us for a free consultation.

How much is my car accident injury worth?

A claim’s value is based on many factors. These factors fall into legal categories called “heads of damages” that set out the types of damages that may be recoverable in a lawsuit.

The severity of your injuries is a major factor in valuing your claim. Our clients’ injuries range in severity, from whiplash and soft-tissue injuries, to broken and fractured bones, to more severe injuries such as traumatic brain injuries, paraplegia and quadriplegia. We also help people who suffer from chronic pain and psychological injuries such as PTSD.

Damages depend on the seriousness of your injuries and the impact on your life. You may be entitled to compensation for:

-

Medical expenses (physiotherapy, prescriptions, nursing care)

-

Loss of income and reduced earning ability

-

Pain and suffering

-

Housekeeping or home maintenance support

-

Funeral costs and death benefits in fatal accidents

You may also have access to Section B insurance benefits following an accident. These benefits are paid by your own insurer in the event of a motor vehicle accident, and cover reasonable and necessary treatment costs, as well as some other associated costs, regardless of who is at fault for the accident. These benefits includes:

-

Up to $50,000 for medical and rehabilitation expenses

-

Weekly income replacement up to $250

-

$100/week for housekeeping assistance (up to 52 weeks)

-

Funeral coverage up to $2,500 and death benefits up to $25,000

You can use our Injury Claim Calculator to learn more about how to evaluate your claim.

What If My Injuries Show Up Days or Weeks Later?

It’s not unusual for some car accident injuries to be felt only days or even weeks after the collision. In the immediate aftermath of an accident, adrenaline and shock can mask pain. Soft tissue injuries like whiplash, muscle strains, and even concussions might not fully develop symptoms until well after the crash. You might feel fine at first, only to wake up with pain in your neck or back a couple of days later.

If you notice injuries or pain days or weeks after your accident, take these actions right away:

-

See a doctor immediately and explain the crash connection.

-

Update your insurer and include new medical records in your claim.

-

Avoid settling too early. Once you sign, you may give up future rights to compensation.

Our car accident lawyers have worked on many cases where symptoms were delayed, and we know how to handle them so you’re treated fairly. Whenever your injuries appear, we can assist in pursuing the compensation you deserve. Contact us for a free consultation.

What If the Other Driver Was Uninsured or Fled the Scene?

Being hit by an uninsured driver or involved in a hit-and-run accident in Sydney, Nova Scotia can be stressful and overwhelming. The good news is that even if the at-fault driver has no insurance or cannot be found, you may still be entitled to compensation. Both Nova Scotia law and standard auto insurance policies provide protections in these situations.

Filing a Claim Against an Uninsured Driver in Sydney

If the at-fault driver is identified but does not have valid insurance, you can make a claim under your own policy’s uninsured motorist coverage (also known as Section D coverage in Nova Scotia). This coverage is mandatory for all vehicles in Sydney and typically provides up to $500,000 in compensation for accident-related losses.

Your own insurer essentially takes the place of the at-fault driver’s insurance company and may cover:

-

Medical bills and rehabilitation expenses

-

Lost wages due to time off work

-

Pain and suffering damages

-

Other accident-related costs within policy limits

What to Do After a Hit-and-Run Accident in Sydney?

If you are the victim of a hit-and-run accident (where the at-fault driver flees and is not identified), the process is similar. To protect your rights:

-

Report the accident to police immediately (within 24 hours).

-

Notify your insurance company as soon as possible.

-

Provide as much evidence as you can, including witness statements, photos, and details of the crash.

Why Legal Help Matters After an Uninsured or Hit-and-Run Accident

Uninsured and hit-and-run claims can be more complicated than a typical accident claim, so it’s wise to seek legal advice. Even though you’re dealing with your own insurer, remember that insurance companies often try to minimize payouts. An experienced personal injury lawyer can:

-

Handle communications with your insurer

-

Ensure your claim is filed correctly and on time

-

Maximize the compensation you receive

-

Represent your interests if disputes arise

Our team has successfully represented many clients in uninsured driver and hit-and-run accident cases in Sydney and throughout Nova Scotia. If you’ve been injured, we can help you understand your rights and fight for the compensation you deserve. Contact us for a free consultation.

Can I sue if a loved one was killed in a car accident in Sydney?

Yes. In the case of a fatal car accident, a loved one’s right to compensation depends on their relationship to the deceased. If you’ve lost a family member in a car accident in Sydney resulting from another person’s negligence, you may be eligible for compensation. In Halifax, a spouse, common-law partner, parent, or child can pursue a claim for wrongful death under Section 5(1) of the Fatal Injuries Act.

How long do I have to file a wrongful death lawsuit in Nova Scotia?

In Nova Scotia, you must file a wrongful death claim within 12 months of the date of death. Speak with an experienced personal injury lawyer to determine your eligibility and ensure that your rights are protected. You can learn more about fatal injury lawsuits here.

Common types of collisions in Sydney

We represent people who have been injured in many different types of motor vehicle collisions in Sydney, including:

- Head-on collisions

- Rear-end collisions

- Side swipes and collisions during a lane change

- T-bone collisions

- Collisions with objects or animals

- Hitting a parked car

- Run off the road by another vehicle

- Vehicle rollovers

- Being hit when turning left into traffic

- Cyclist accidents

- Pedestrian accidents

If you have been injured in an accident and need help determining who is at fault and what compensation you are entitled to, contact us for a free consultation. We serve clients throughout Nova Scotia from our Halifax office and New Glasgow Office. We can also meet by phone or virtually.

Yes. You are required to notify your insurance company after an accident in Sydney, but you are not required to give a detailed recorded statement right away. Insurance adjusters may use your words against you to reduce your claim. Stick to the basic facts (time, place, vehicles involved) and avoid speculation. A personal injury lawyer in Sydney, Nova Scotia can advise you on what to say and even communicate with the insurer on your behalf to protect your rights.

In Nova Scotia, fault in a car accident is determined using the Motor Vehicle Act, insurance company fault determination rules, police reports, witness statements, and physical evidence from the crash scene. Sometimes, more than one driver can share fault. If you disagree with how fault was assigned, a Sydney personal injury lawyer can investigate, gather additional evidence, and challenge the insurer’s decision to ensure you are treated fairly.

Yes. If you are injured in Sydney by an uninsured driver, you can make a claim through your own auto insurance under Section D, which is mandatory in Nova Scotia. This coverage typically provides up to $500,000 for medical bills, lost wages, pain and suffering, and other damages. A skilled Sydney car accident lawyer can help you navigate the process and secure the compensation you deserve.

Yes. If you were the victim of a hit-and-run accident in Sydney, you can still pursue compensation under the unidentified motorist provisions of your auto insurance policy. To protect your rights, report the accident to police within 24 hours and notify your insurer as soon as possible. Hit-and-run claims can be complex, but a Sydney personal injury lawyer can guide you through the process and fight to maximize your recovery.

Yes. If a loved one was killed in a car accident in Sydney due to someone else’s negligence, close family members such as a spouse, parent, or child may be eligible to file a wrongful death claim under Nova Scotia’s Fatal Injuries Act. Compensation can cover funeral expenses, loss of financial support, and loss of companionship. These claims must be filed within 12 months, so contacting a Sydney wrongful death lawyer as soon as possible is crucial.

Have questions for our team?

Frequently Asked Questions

- How can I help my personal injury lawsuit to get the best settlement?

- 7 steps to take after a car accident to help your injury claim

- How can a lawyer help with my personal injury claim?

- Can you sue a driver whose identity or insurance details are unknown?

- Is the parking lot 50/50 myth true?

- Can I sue if I was in a car accident at work in Nova Scotia?

- Can apologizing after an accident impact your claim?

- Am I covered by insurance if I was driving someone else’s car?

- Can I still sue if I wasn’t wearing a seatbelt?

- Can I sue my rideshare (Uber, Lyft) driver?

- What is whiplash?

What Our Clients Say...

Request a

Free Consultation

If you would like to learn your legal options at no obligation, contact us today to set up a free consultation.